Invest with

Passion

From €100, co-invest in ultra rare and profitable goods.

Luxury items perform better than other types of investments

Having a diversified portfolio is the grail of any investor. It allows you to seek profitability while minimizing your risk. The majority of savers do not have enough wealth to invest in diversified assets and do not wish to manage them. This is why we have created a new savings tool that gives the power to save efficiently and without constraints. By optimizing the profit/risk balance.

All-inclusive solution

Diversified savings for all. At last!

- We centralize the best investment opportunities in the Diversified application.

- With an entry ticket of 100€, it would be a shame not to diversify your savings!

Cost-effective, simple

and efficient.

- In France and throughout Europe, demand the best from your money.

- Our objective is to select assets with an estimated return of at least 10% per year.

Total freedom.

You are the boss.

- Make your assets grow by following your own strategy.

- Control your risk level with the information available on the platform.

- Resell your holdings when you need cash. In total freedom on the secondary market (under consideration) integrated into the app.

How it works?

Manage your investments in rare and profitable goods on the app.

Listing

Of an exceptional high-yield asset on the Diversified app.

Co-investing

The asset is divided into DIFIED worth €10 each at emission. You can buy as many DIFIED as you like.

Appreciation

A period of 3 to 7 years during which you can monitor the estimated value of your portfolio. And make new investments.

Sale

The asset is sold at the best price within 6 months after the investment period. You will then be credited with the net proceeds of the sale!

Simulate your investment

The value of luxury assets has exploded in recent years.

La tâche 2000

Audemars Piguet

Domaine de la Romanée conti

Make your simulation:

Result of what you’d have:

the net profit if you had kept it for

3 yearsBased on actual data from our partner.

What our community thinks of us

One single app

A single app to manage your investments in ultra-rare and profitable assets.

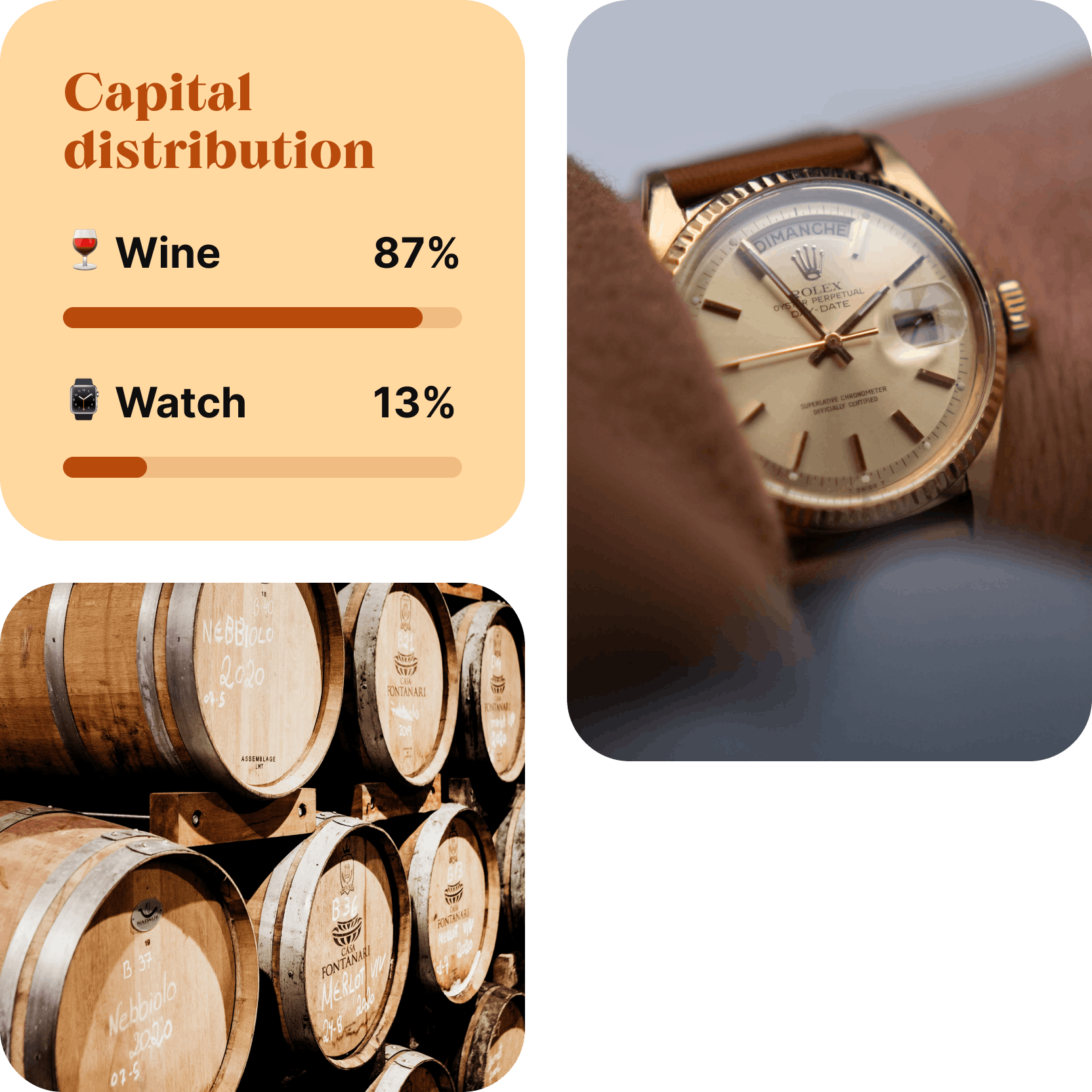

A concentrate of expertise in asset selection

You are no longer alone in the market. Diversified relies on professionals in each sector to beat the market.

A solution that takes care of everything for you

You don't want to source the goods? To store them, insure them and resell them? We take care of it for you

Finally an app that knows what profitability means

Making you earn 2% per year is useless. With our partners, our goal is to make you earn between 8 and 20%. Counter-performances can happen but we work to make them the exception!

Diversified: what is it?

Diversified is not simply an investment platform, but operates as an SPV capable of issuing tracking bonds. In practical terms, this means that you own a bond security, which guarantees that you will receive the net sale price at the end of the investment period. Our bond issues are registered with the relevant financial authorities (CSSF in particular). Diversified takes care of everything to transform the asset into an "investable" financial product. We work with partners to acquire rare collectibles at competitive lower prices. We anticipate that selected assets will increase in value over time due to the nature of their rarity, brand awareness and expressed collector interest. We work with experts in each category who have decades of experience in the proposed asset families. For example, Patriwine already manages millions of assets with outstanding returns. We believe that asset selection should be steered by professionals with a clear vision of the market, in order to reconcile passion and performance.

What is a Dified and what is its value?

DIFIED is the name given to our securities on Diversified. There is a different DIFIED for each new asset issue. At introduction, a DIFIED is always worth €10. Its value is then determined by the market. Note: Comparing the value of the DIFIED with its introduction value is a simple way of finding out whether the investment has performed well!

Who can use Diversified?

Any European resident over 18 with a bank account can invest with Diversified

What security for Diversified’s assets?

Our partners are responsible for the storage and insurance of the goods sold up to 100% of the market value of the goods. They all have decades of experience in the storage of high-yield assets: wines, spirits or exceptional watches. In cases where Diversified sources the assets itself, the storage is entrusted to a professional of the sector and the insurance is taken out under the same conditions of security with a duly approved insurer. All assets held by Diversified on behalf of its clients can be "visited" by the Diversified community (see the section provided for this purpose).